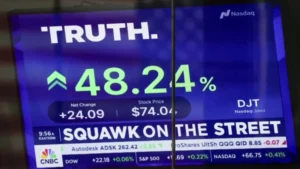

Expert Analysis: DJT Stock Price Surge

The recent surge in DJT stock price has caught the attention of investors and analysts alike. Understanding the key factors influencing DJT stock, recent performance analysis, and market trends impacting its trajectory is crucial for making informed investment decisions. Additionally, exploring the potential growth opportunities, challenges in sustaining the price surge, expert recommendations, and the impact of external economic factors is essential for forecasting the future of DJT stock. In this blog post, we will delve into expert analysis to provide valuable insights into DJT stock quote price and forecast.

Expert Analysis: DJT Stock Price Surge Key Factors Influencing DJT Stock

When analyzing the factors influencing DJT Stock Quote Price and Forecast, it is crucial to consider a variety of elements that can impact its performance in the market. Here are the key factors to keep in mind:

- Company Performance: The financial performance and strategic moves of DJT Stock over the recent quarters can significantly influence its stock price and forecast. Positive financial results and successful business strategies often lead to an increase in stock value.

- Industry Trends: The broader trends within the transportation industry can also have a direct impact on DJT Stock. Factors such as changes in demand for transportation services, regulatory developments, and technological advancements within the industry can all affect the stock’s performance.

- Economic Indicators: Economic indicators, including inflation rates, GDP growth, and employment figures, can indirectly influence DJT Stock. For instance, an economic slowdown might lead to reduced demand for transportation services, which could affect the stock price.

- Political and Regulatory Environment: Changes in government policies, trade regulations, or environmental standards can have a significant impact on transportation companies like DJT Stock. Keeping an eye on any legislative developments that could affect the company’s operations is crucial for understanding its stock performance.

Considering these key factors is essential for gaining insights into DJT Stock’s current price surge and making informed forecasts about its future performance.

In summary, the stock’s performance is influenced by the company’s financial standing, industry trends, economic indicators, and the political and regulatory environment. These elements collectively shape the trajectory of DJT Stock Quote Price and Forecast in the market.

Expert Analysis: DJT Stock Price Surge

Recent Performance Analysis

When it comes to DJT Stock Quote Price and Forecast, understanding recent performance is crucial for investors. Here’s a snapshot of the recent performance analysis:

- Price Surge: DJT stock has experienced a notable surge in recent weeks, reflecting a positive market sentiment and potential growth opportunities.

- Comparative Analysis: It’s important to compare DJT’s recent performance with its industry peers and benchmark indices to gauge its relative strength.

- Volatility: Despite the price surge, there has been noticeable volatility, which may indicate short-term fluctuations in the stock’s value.

- Trading Volume: Analyzing the volume of trades can provide insights into investor interest and confidence in the stock’s future performance.

- Earnings Reports: Reviewing the company’s recent earnings reports and financial statements is essential for understanding the underlying factors driving the stock price.

By considering these recent performance factors, investors can make more informed decisions about the potential trajectory of DJT stock in the market.

Expert Analysis: DJT Stock Price Surge Market Trends Impacting DJT Stock

When analyzing the DJT Stock Quote Price and Forecast, it’s crucial to consider the market trends that are currently impacting its performance. Several key trends are driving the movement of DJT stock, including:

- Industry Trends: The transportation industry’s overall performance directly influences the DJT stock. For example, changes in consumer demand for shipping and logistics services can significantly impact the stock’s price and forecast.

- Economic Indicators: The performance of the broader economy, including factors such as GDP growth, inflation rates, and consumer spending, can have a direct impact on DJT stock. Investors closely monitor these economic indicators to anticipate the stock’s movement.

- Regulatory Changes: Shifts in government regulations related to the transportation sector can influence the operational costs and profitability of companies within the industry. As a result, regulatory changes can impact the stock’s price and forecast.

By analyzing these market trends, investors and analysts can gain valuable insights into the factors influencing DJT stock. Keeping a close watch on these trends is essential for making informed decisions regarding the stock’s potential price movements and forecasts.

Expert Analysis: DJT Stock Price Surge Potential Growth Opportunities

When analyzing the potential growth opportunities for DJT Stock Quote Price and Forecast, it’s essential to consider the following factors:

- Market Expansion: DJT has been eyeing expansion into emerging markets, presenting an opportunity for significant growth in new geographic areas.

- Diversification of Services: By diversifying its service offerings, DJT can tap into new revenue streams and target a broader client base, potentially driving stock price growth.

- Strategic Partnerships: Collaborating with industry leaders or complementary businesses can open doors for DJT to access new markets, technologies, or resources, fueling its growth in the long run.

- Technological Innovation: Embracing and investing in cutting-edge technologies can significantly enhance operational efficiency, attract new investors, and boost the stock price.

- Mergers and Acquisitions: Strategic acquisitions or mergers can provide DJT with synergies, expanded market presence, and enhanced competitive advantage, potentially leading to exponential growth in stock value.

Considering these growth factors, investors may find DJT Stock to be an attractive opportunity for potential returns in the long term.

By leveraging these growth opportunities, DJT Stock Quote Price and Forecast can experience substantial appreciation, aligning with the company’s expansion and diversification efforts.

Expert Analysis: DJT Stock Price Surge Challenges in Sustaining the Price Surge

As exciting as the recent price surge of DJT stock may be, there are certain challenges that need to be considered for sustaining this momentum. Here are the key factors contributing to the challenges in maintaining the price surge:

- Market Volatility: The stock market is inherently volatile, and sustaining the price surge of DJT stock may be impacted by market fluctuations and unexpected events.

- Competitive Pressures: DJT stock operates in a competitive industry, and maintaining the price surge could be challenging amidst the competition from other players in the market.

- Economic Uncertainties: Economic uncertainties, both domestically and globally, can have a direct impact on the stock price. Fluctuations in GDP, inflation rates, and interest rates can influence investor sentiments.

- Regulatory Changes: Any new regulations or changes in existing ones can impact the operations and financial performance of the company, thus affecting the stock price.

- Company Performance: DJT stock’s ability to sustain its price surge is closely linked with its own performance. Any setbacks in financial results or business operations can lead to a decline in stock price.

Ensuring the sustainability of the price surge will require careful monitoring of these challenges and strategic planning to mitigate potential risks.

By being aware of these challenges, investors can make informed decisions regarding DJT stock quote price and forecast.

Expert Recommendations and Insights

When it comes to DJT Stock Quote Price and Forecast, experts have offered valuable insights and recommendations based on thorough analysis and market knowledge. Here are some expert recommendations and insights to consider:

- Diversify Your Portfolio: Experts suggest diversifying your investment portfolio to mitigate risks associated with the volatile nature of DJT stock.

- Long-Term View: It’s recommended to take a long-term perspective when investing in DJT stock, considering the potential impact of external economic factors over time.

- Monitor Market Trends: Experts emphasize the importance of closely monitoring market trends and industry developments to make informed investment decisions regarding DJT stock.

- Consult Financial Advisors: Seeking guidance from financial advisors who specialize in stock investments, particularly in the transportation industry, can provide valuable insights for making informed choices.

- Risk Management Strategies: Implementing effective risk management strategies is crucial when dealing with DJT stock, given its susceptibility to market fluctuations and external influences.

By heeding these expert recommendations and insights, investors can navigate the complexities of DJT stock with a well-informed approach.

The Impact of External Economic Factors

When analyzing the DJT Stock Quote Price and Forecast, it’s important to consider the influence of external economic factors on the stock’s performance. External economic factors play a significant role in shaping the price and forecast of DJT stock. Here are some key points to consider regarding the impact of external economic factors:

- Global Economic Conditions: Fluctuations in global economic conditions, such as GDP growth rates, trade agreements, and geopolitical events, can directly impact the stock market, including DJT stock.

- Interest Rates: Changes in interest rates set by central banks can affect borrowing costs, consumer spending, and overall investment sentiment, which in turn influence the stock’s price and forecast.

- Inflation Rates: Rising inflation can erode purchasing power and corporate profitability, leading to shifts in investor confidence and affecting the stock’s performance.

- Currency Exchange Rates: Exchange rate movements can impact the competitiveness of multinational companies, potentially influencing DJT stock, particularly if the company engages in significant international trade.

Considering the interplay of these external economic factors is crucial in forecasting the price trajectory of DJT stock and making informed investment decisions. It’s important for investors and analysts to remain vigilant about global economic developments and their potential impact on the stock market.